Decoding Beauty sector in the African continent.

Beauty sector in Africa

The beauty & fragrance sector is the closest to my heart; living in the African continent for over 11 months now and observing the beauty trends amongst millennials and Gen Z daily, I am going down pen down some of my learnings.

The Beauty market:

This market, currently valued at $65.93 billion with a 5.99% CAGR, encompasses a wide range of products, from skincare and haircare to cosmetics and fragrances.

The population aged 17 years and younger amounted to approximately 650 million. Source Statista.

This young population is fueling the growth of the beauty and fragrance sector in the region.

To discover why fashion houses launching their fragrance lines, click here

The Challenge:

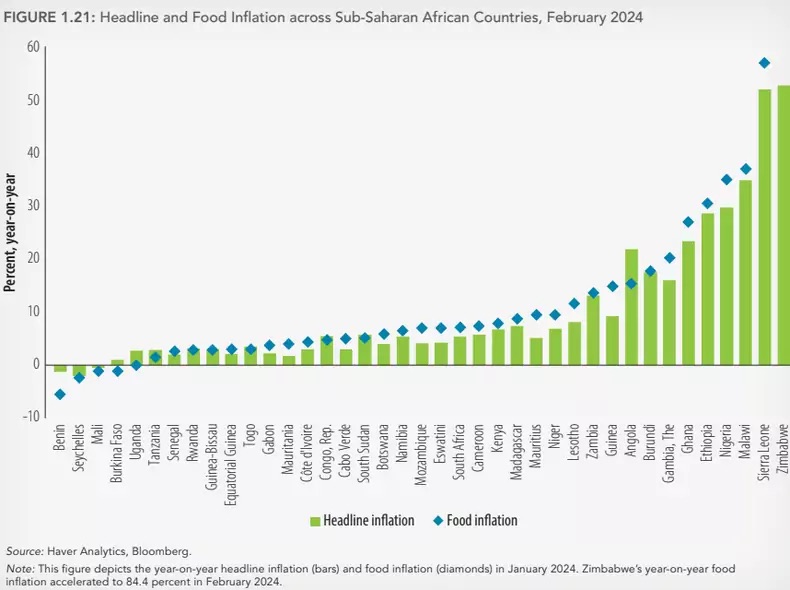

However, despite its potential, the African beauty industry is not immune to the economic challenges that many countries face.

Heavyweight countries like Nigeria, for example, continue to experience financial fluctuations and economic instability which present significant hurdles for beauty brands operating in Africa.

One of the most pressing issues affecting the African economy, and therefore brand founders, is the high inflation rate.

For instance, according to Trading Economics, Nigeria’s inflation rate accelerated to 34.19% in June 2024, amid the removal of fuel subsidies and a weakening local currency.

The Impact:

The above factors contribute to reduced consumer spending and increased operational costs for businesses, including those in the beauty industry.

Product price rises with the currency depreciation, resulting in less offtake from the shelves by the customers.

Inflation led to recessionary pressures across the sector, reducing customer offtake, and throwing all the controls like inventory planning, etc out of control.

Underlying belief in Consumer’s preferences:

There is an underlying emphasis on beauty regime and grooming standards amongst women & that is one of the reasons that the beauty sector is still registering growth in the continent despite all challenges.

Especially the skincare, hair (wigs/artificial hair extensions) and fragrances. (edts, body sprays, deos, bath & body ranges, perfumed wet wipes, etc)

From my personal experience, Perfumes & cosmetics is the highest contribution category. (I have experienced a similar trend in the Gulf region as well as in Travel retail – wherein perfumes & cosmetics were the third biggest category drivers after tobacco and liquor).

Brands in the market are mostly sourced from China, Portugal, Brazil etc. However, there are plenty of locally manufactured brands as well which hold the potential to grow in price-sensitive markets as they can bring out smaller packs to mitigate the currency depreciation impact.

Economical ways to reach these customers:

Building your community.

By establishing strong relationships with local communities and consumers can provide beauty brands with valuable insights into consumer preferences and economic conditions, at little to no cost to the brands.

Engaging with communities using WhatsApp groups, and FB groups is one of the most effective ways to market beauty brands here in the African continent.

Influencer marketing is also seen as an effort to build online communities for promoting beauty brands.

Tips for creating a resilient & sustainable beauty business in Africa:

- localize production capabilities using local ingredients

- flexible pricing strategies,

- leveraging digital platforms & building communities

- diversifying product offerings,

- educating consumers on beauty and grooming regimes.

If you are a business owner operating in the beauty/fragrance/fashion genre & want to grow your business & need a retail expert to help you achieve your “Vision to Reality” framework & strategize your business then feel free to schedule a discovery listening call over a #coffeechat. Inbox your text and my team shall reach out to you.